Keywords: Limit Tax Credit, Income Tax (VAT) of Article 24, Ms. This is done in order to avoid double pejak so as not to burden the detriment of taxpayers. Foreign tax creditable done in the company consolidated income from abroad with income in Indonesia but does not exceed the calculation of tax payable by the Income Tax Law. Indonesia implemented a policy of crediting method is limited (Ordinary Credit Method) by applying maximum tax credit calculation is done for each country (per country limitation). PPh 25 bagi OPPT 0.75 x omzet bulanan tiap masing-masing tempat usaha. Each year, Indonesia continues to increase state revenues through tax sector which will be used to build the country's economy through infrastructure development and development of other important sectors. Calculation of income tax paid or payable abroad that may be credited against income tax payable on the total income tax payer in the country has been set out clearly by the provisions of Article 24 of the Income Tax Act. Surat Pemberitahuan Tahunan (SPT) pajak penghasilan badan dan.

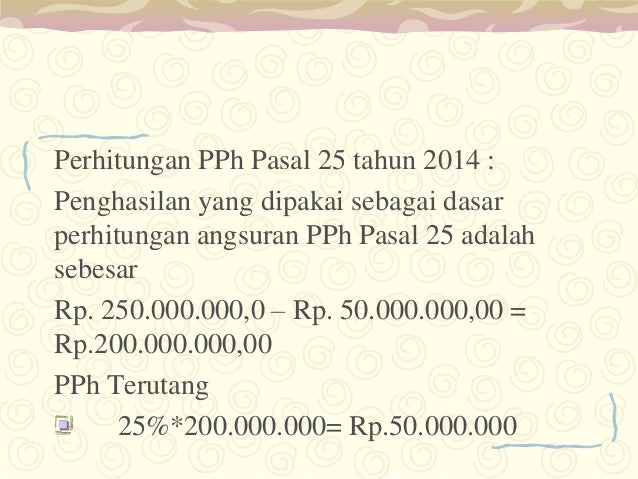

There are many ways for a country's income can continue to grow, one of them through the tax sector. Nomor 4 Tahun 2009 tentang Pertambangan Mineral dan. Pajak Penghasilan Terutang: 25 x Rp 600.000.000. PT Bahari melakukan pembetulan SPT Tahunan PPh tahun pajak 2011 pada tanggal 16 Agustus 2012, dengan data baru sebagai berikut: Penghasilan Neto/Penghasilan Kena Pajak. With the increase in personal income residents of a country will automatically increase the income of a country anyway. PPh Pasal 25 masa Desember 2011 yaitu sebesar Rp 6.000.000. The goal of each state is established is to improve the lives or well-being of its people are reflected in the revenue / increasing personal income.

0 kommentar(er)

0 kommentar(er)